Transform a cost center into a profit center with Payments Marketplace

Founded over 10 years ago and spanning 14 markets globally, Rokt’s machine learning technology powers more than 2.5B global transactions annually by unleashing relevancy in ecommerce. Since our start, we’ve invested $157 million in research and development to adapt to the changing ecommerce landscape and help businesses solve their most challenging problems. A challenge all ecommerce sites currently face is the cost associated with the payments page. This page has always been a major cost center for businesses due to processing fees driven from credit cards and Buy Now Pay Later (BNPL) plans. Rokt’s Payments Marketplace solves this challenge by providing a way for ecommerce sites to unlock untapped revenue opportunity on the payments page, offsetting these costs, while delivering the most relevant customer experiences.

With Payments Marketplace we provide value to both payment providers and ecommerce partners as ecommerce and digital payments become more integrated. For ecommerce partners it converts static, fixed-real estate on the payments page into a flexible experience with advanced machine learning, pairing individuals 1:1 with offers they’re most likely to engage with. Additionally, payment providers and BNPLs can reach the most qualified potential cardholders or customers with the most relevant offers with Rokt’s machine learning technology. With Payments Marketplace we’ve aligned all 3 parties. It offsets the cost center of the payments page for brands while allowing payment providers a new avenue for reaching prospective customers, all while enhancing the end user experience. It’s a win-win-win for the ecommerce brand, payment provider, and the customer.

Providing value for customers with relevancy

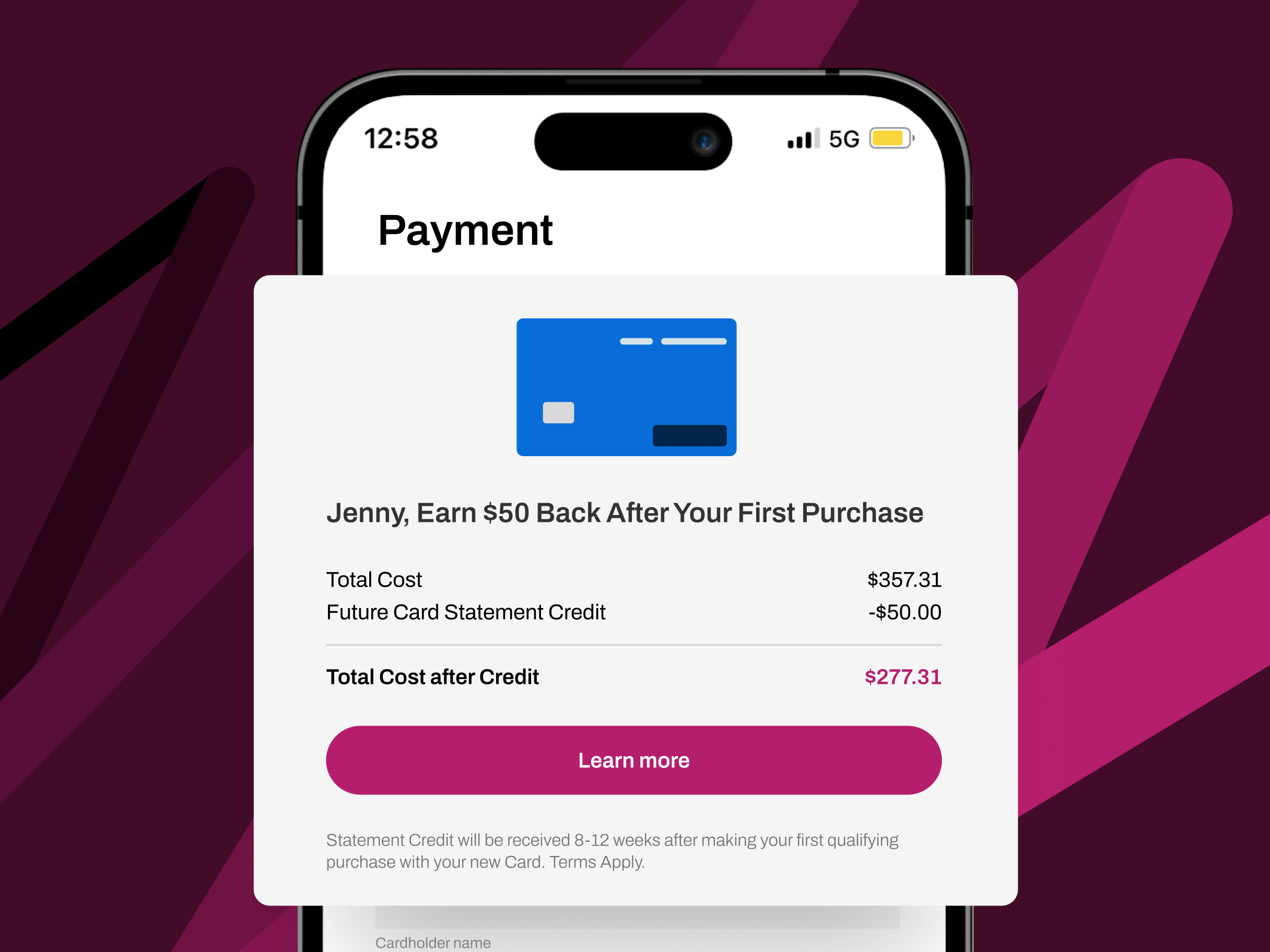

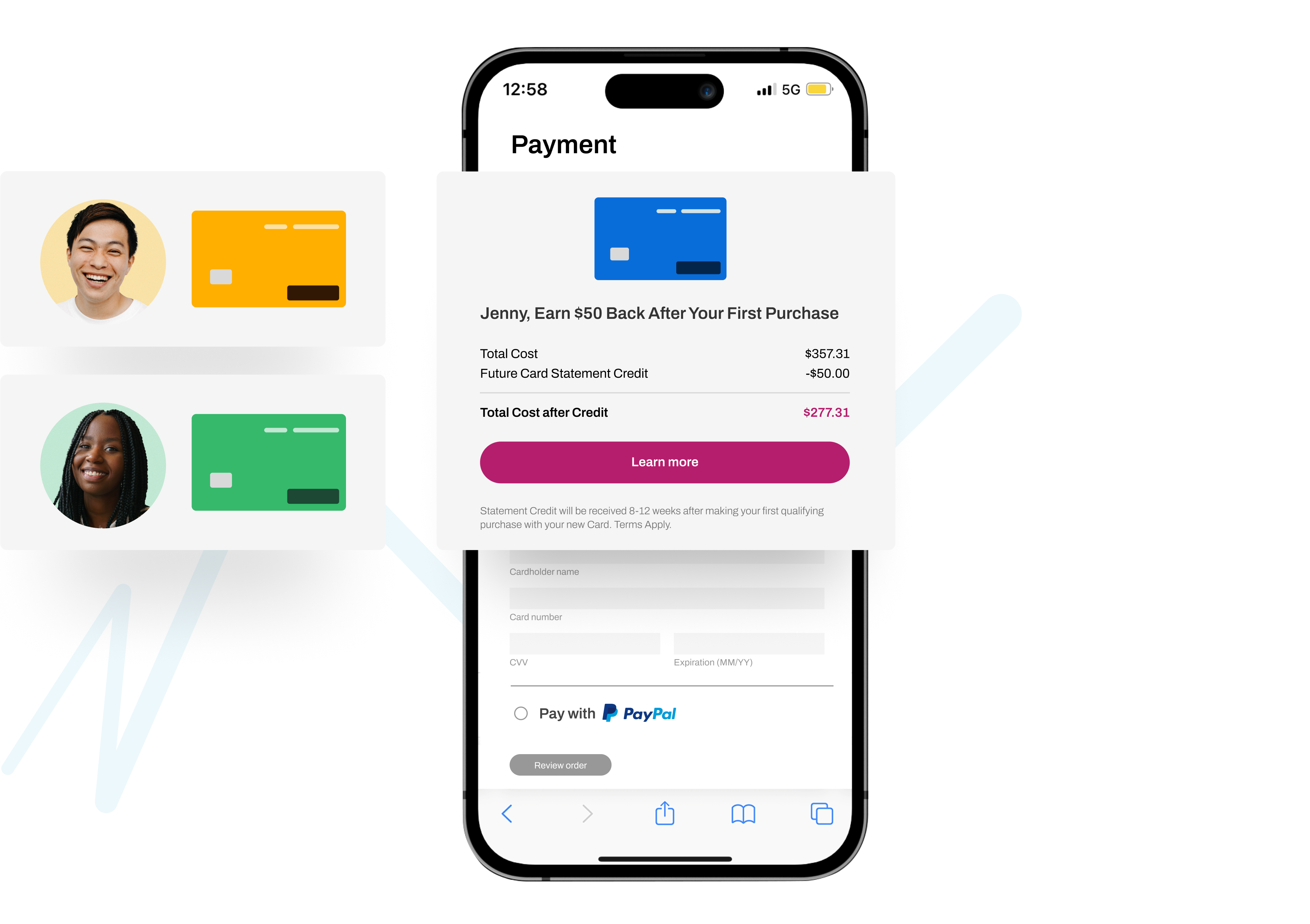

Payments Marketplace was built with the end user in mind. With thousands of credit card offers in-market today, it’s essential that brands and payment providers add value and relevancy to their shoppers’ experience. Payments Marketplace holds a deep focus on relevancy and one-to-one experiences powered by machine learning. By unleashing first-party data, machine learning identifies, selects, and delivers entire experiences tailored to shoppers’ interests. Its capabilities determine if someone will respond better to a travel card, cash back rewards, or even payment installments with a BNPL. It’s not just about giving your customers an offer to acquire a new credit card or sign up for a BNPL, it’s an opportunity to show that brands know their shoppers well enough to present a path that’s relevant to the way they purchase.

How brands can drive revenue directly from the payments page

The market for payment provider offerings is expansive, with a multitude of diverse credit cards, digital wallets, and BNPLs proliferating the space. Rokt helps ecommerce businesses navigate this crowded landscape by determining the most relevant experience for each individual customer. With Payments Marketplace, ecommerce partners can lead with customer relevancy while turning the payments page into a revenue generating opportunity. When the Rokt Ecommerce platform is integrated, the technology acts as a trusted intermediary connecting ecommerce clients to a marketplace of premium offers from leading payment providers. Payments Marketplace is an extension of the same technology Rokt uses to power relevant offers on the checkout confirmation pages of ecommerce sites. This technology enables partners to take full control of provider selection and placement design, ensuring a native, seamless experience for customers.

Acquiring new customers for payment providers

Rokt’s Payments Marketplace helps payment providers acquire new, high-value customers by using payment-related offers from leading credit cards, digital wallets, and BNPLs directly on the payments page. Payment providers can now connect with new prospects while they’re highly engaged with their wallets already in hand. Ecommerce sites then utilize first-party targeting to reach those engaged customers while providing relevant, exclusive inventory from top payment brands. Through these placements customers can discover and apply for a credit card, digital wallet, or BNPL without disrupting the checkout experience.

Award-nominated technology

Since the launch of Payments Marketplace, we’ve earned positive recognition across the industry, including being named as a runner up for the Payment Solutions Technology Award at the 2022 UK Ecommerce Awards. We’ve gained momentum by partnering with premium payment providers and BNPLs like Wells Fargo to help acquire new, high-value customers across leading ecommerce companies like Marcus Theatres, Teleflora, Splash Wines, and CDKeys. Through Payments Marketplace, we’re looking forward to driving further success for brands and payment providers by transforming the economics of the payments page.

Interested in Payments Marketplace? Talk to an expert to get started.