The future of fintech advertising: how emerging technologies are changing the game

As the fintech industry continues to grow, innovative advertising strategies are becoming essential to capture the attention of potential customers and stand out in a cluttered marketplace. Historically, the financial services industry relied heavily on traditional advertising methods, such as TV and print ads. However, the rise of digital has presented an opportunity to reach customers at more meaningful and contextually relevant moments while also better understanding attribution and incremental impact of ad dollars. As a result, these companies are increasingly turning to innovative digital ad strategies that are more likely to capture the attention of their target audience.

The evolving landscape of fintech advertising presents both challenges and opportunities. By using innovative ad strategies and channels, while staying up-to-date on the latest regulations, financial service companies can reach their target audience and build trust with their customers.

Leveraging Rokt for fintech innovation

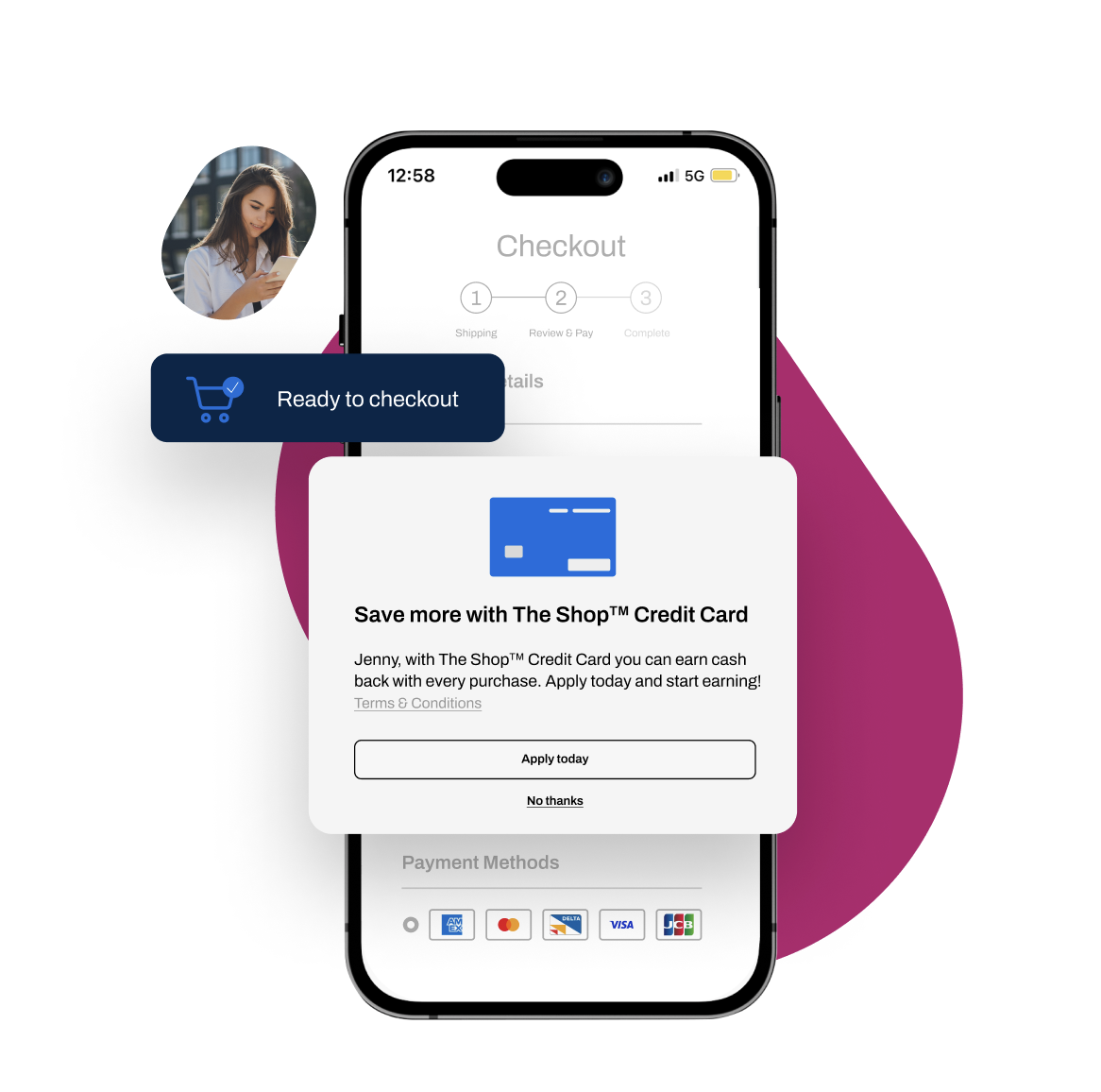

Rokt is at the forefront of revolutionizing digital advertising. Rokt’s platform allows advertisers to reach high quality and highly incremental customers during key moments of the transaction journey on major ecommerce sites. Rokt’s marketplace acts as a trusted intermediary, helping both ecommerce businesses and marketers seize the full potential of every transaction to grow revenue and acquire new customers at scale—from cart to confirmation page. By leveraging Rokt’s technology, brands can reach new customers at the perfect moment—the transaction moment.

Build direct relationships with customers through a unique acquisition channel

It’s no secret the digital age has brought information overload. Customers are shown hundreds of ads every day while browsing online. This poses a challenge for financial institutions to compete in the open web for eyeballs at an efficient cost. In the ecommerce environment, contextual relevance for these brands is high–and so is competition. Generally, marketing in this journey is dominated by private label credit cards (PLCC) and buy now pay later (BNPL) relationships, often with exclusivity that blocks other brands from this environment. It can have a negative impact on customer experience, since customers are shown the brand with the biggest checkbook rather than the highest relevance. However, Rokt has changed the game by giving payment providers a way to reach consumers at the point of purchase.

Rokt’s Payment Marketplace offers a valuable opportunity for finserv brands to engage with customers during the transaction. This moment possesses unique advantages for advertisers. At this point, shoppers are in a purchasing mindset, fully focused and engaged. This brand-safe environment leverages first-party transaction data to deliver messages and experiences that deliver results. For finserv brands this means new cardholder acquisitions at scale.

Personalized marketing that drives engagement and loyalty

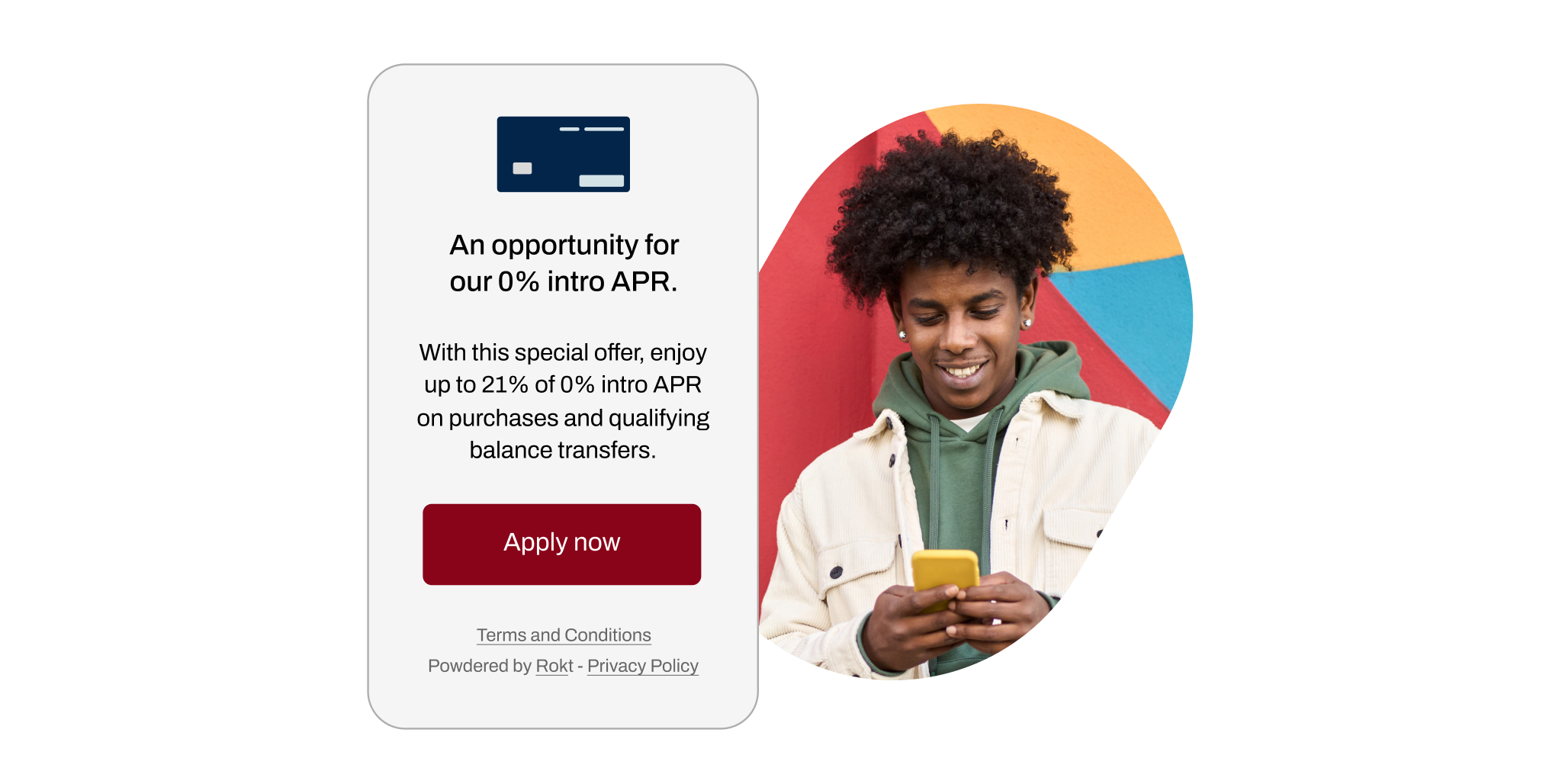

Building direct relationships with customers is essential for any business that wants to succeed. Rokt empowers you to harness first-party transaction data, ensuring both brand and privacy safety, to enhance performance results. With exclusive access to over two billion annual transactions leveraging advanced AI technology, you can maximize your desired outcomes with intent-based predictions that ensure you show the right ad message to each person. When your customers feel like you understand them and are providing them with relevant offers, they are more likely to engage with your brand and become loyal customers.

Rokt’s closed ecosystem: verified data enables best-in-class advertiser tools

With Rokt’s closed and secure marketplace, advertisers have complete control over their own audiences and data. Customer data is never shared with or exposed to third parties. Instead, Rokt acts as a trusted intermediary, optimizing for relevancy and then creating the best outcomes for both sides of the marketplace. With complete control, advertisers can leverage unique transactional data to reach the right audience, targeting only the Fair Lending Act (FLA)-compliant attributes you want to target.

Average order value

Reach high spending or budget-conscious customers with relevant offers.

Industry vertical and sub-vertical

Provide card options based on where customers are shopping and what they’re buying.

Third-party audiences

Access highly niche audiences with categories like interests and professional qualifications.

Custom audiences

Use custom lists for suppression or customer retargeting.

Advanced personalization and 1:1 targeting

Uncover highly qualified applicants no matter where they are shopping with outcome-driven machine learning. By using intent-based predictions Rokt ensures you show the right ad message to each person in a highly personalized way. Using a cost per click (CPC) model and a competitive live-auction marketplace, brands only pay for performance. With an average click-through rate (CTR) of 4.8% and a viewability rate of 95%, Rokt’s ads are not just seen, but they also generate tangible results, capturing the consumer’s undivided attention during their buying journey.

Outcome-driven machine learning

Optimize to each individual to show the right ad message to each person.

Intent-based predictions

Rokt uses proprietary targeting technology to ensure that its ads are seen by the people who are most likely to be interested in them.

Pay for performance

Only pay for performance with a CPC model and a competitive live auction.

The future of fintech advertising

Rokt’s Payments Marketplace unlocks opportunities to influence and acquire customers at the perfect moment—the transaction moment. With premium, exclusive inventory, the ability to target using transactional attributes, and white glove campaign management, finserv companies can uncover new incremental customers who are ready to apply.

Learn more about how Rokt Ads can help you reach your target audience and drive results.